pay indiana state sales taxes

317 232-2240 8 am. Restaurants In Matthews Nc That Deliver.

Taxjar Woocommerce Website Design Sales Tax

When you receive a tax bill you have several options.

. This is really the only return that is available to report sales and use. Opry Mills Breakfast Restaurants. For example if you bought the two-year-old SUV for the original retail price of.

The listed sales tax rate for Indiana is currently at 7 percent. This registration can be completed in INBiz. Groceries and prescription drugs are exempt from the Indiana sales tax Counties and cities are.

You can determine the amount you are about to pay based on the Indiana excise tax table. To register for Indiana business taxes please complete the Business Tax Application. How To Pay Indiana State Sales Tax.

Any business meeting these qualifications must register with the Department of Revenue. Pay Taxes Electronically DOR Online Services Pay Taxes Electronically INTIME INTIME provides access to manage and pay individual income and various corporate and business tax obligations. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient.

Indiana has a flat statewide income tax. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. Late filed returns are.

Tangible personal property and goods that you sell like furniture cars. For more information visit INTIME. The Indiana state sales tax rate is 7 and the average IN sales tax after local surtaxes is 7.

You may also need to complete the FT-1 application for motor fuel taxes including special fuel or. In 2017 this rate fell to 323 and has remained there through the 2020 tax year. Pay Taxes Electronically Customers can quickly and securely pay their taxes electronically.

Payment Plan Set up a payment plan online INBIZ Indianas one-stop resource for registering. For Those in State You can file your Indiana States sales tax collected with Form ST-103 or do it online through the INTax website. Indiana State Sales Tax information registration support.

If you previously registered to file withholding sales FAB CIT or other trust taxes you must still file a 0 returns even if there is no tax revenue or activity for that period. Ready to access the Indiana Taxpayer Information Management Engine INTIME. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply.

Send in a payment by the due date with a check or money order. You may make payments using credit cards either online or over the phone. All Indiana residents pay the same tax rate.

How do I contact Indiana Department of Revenue. Dial 866-729-4682 and follow the prompts. Contact Information for the Indiana Department of Revenue.

Indiana personal income tax rates. Youll typically need to collect Indiana sales and use tax on. However many counties charge an additional.

You will pay Indiana sales and use tax by. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one. Make a decision on your preferred mode of payment.

The Indiana Department of Revenues DOR current modernization effort includes the Indiana Taxpayer Information Management Engine INTIME DORs e-services portal for customers to. Step 3 Pay by telephone using MasterCard Visa Discover or American Express. You will need the same taxpayer identification information listed.

This blog provides instructions on how to file and pay sales tax in Indiana using form ST-103. Make a Payment via INTIME. Ad New State Sales Tax Registration.

How to Make Payments for Indiana State Taxes. After your business is registered in Indiana you will. Residents of Kentucky Michigan Ohio Pennsylvania and Wisconsin who earn income in Indiana dont have to pay Indiana state income taxthey only pay taxes to their own.

A Visual History Of Sales Tax Collection At Amazon Com Itep

The Consumer S Guide To Sales Tax Taxjar Developers

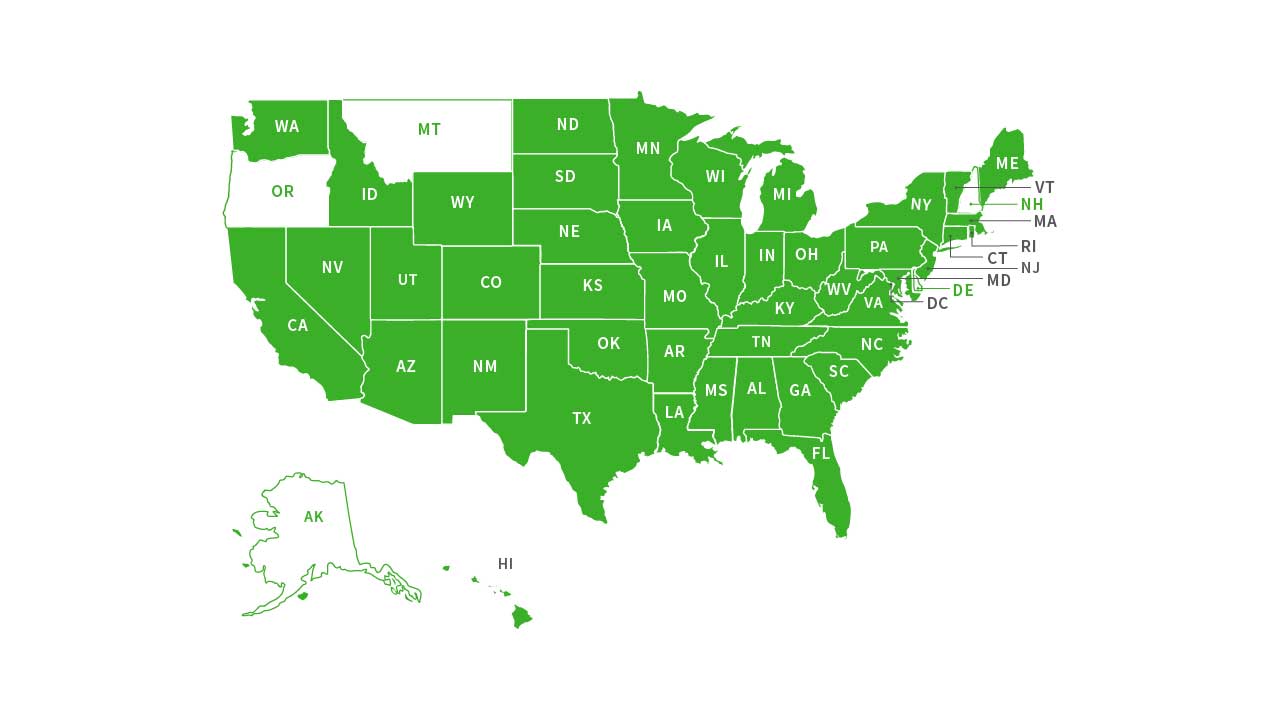

States Without Sales Tax Article

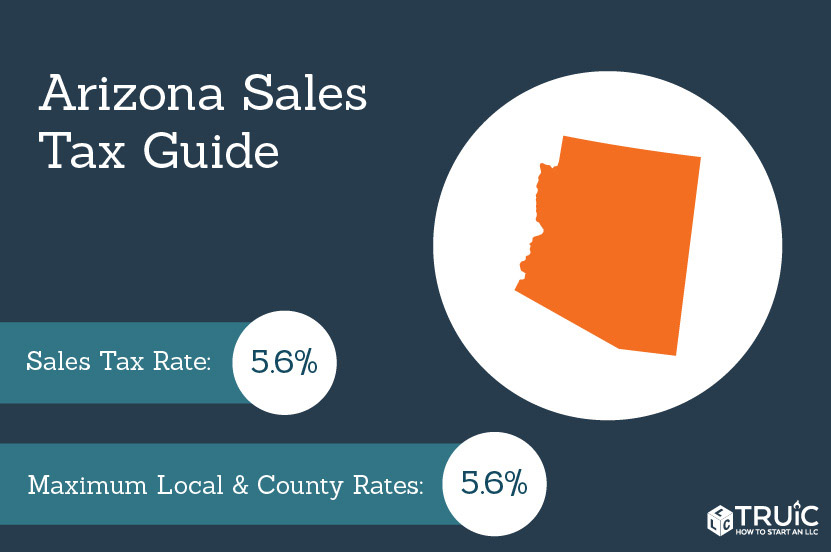

Arizona Sales Tax Small Business Guide Truic

Sales Tax By State Is Saas Taxable Taxjar

Recently Amazon Com Announced That It Would Begin Collecting Sales Tax For Sales In Some States Today From The Vault Money Smart Week Smart Money State Tax

State Sales Tax Jurisdictions Approach 10 000 Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

A Visual History Of Sales Tax Collection At Amazon Com Itep

Tax Exemption Google Search State Tax Tax Exemption Agreement Quote

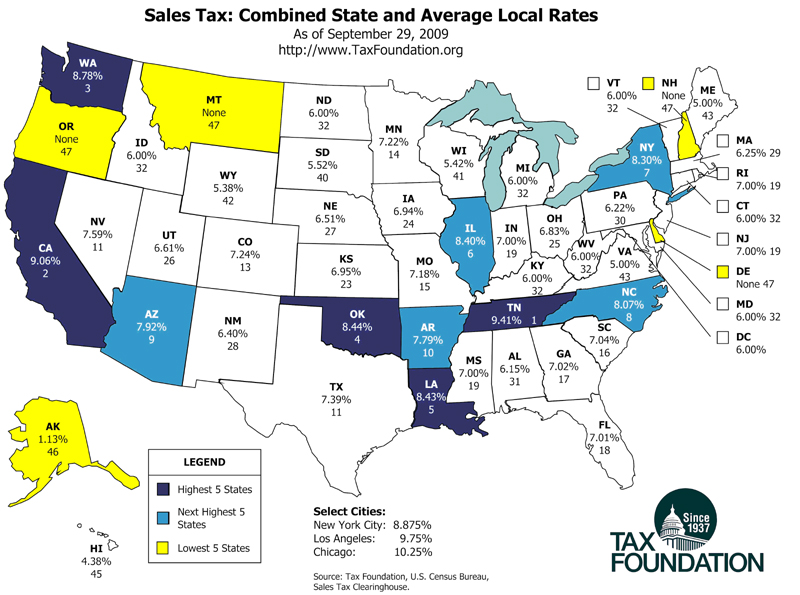

Updated State And Local Option Sales Tax Tax Foundation

Get Ready To Pay Sales Tax On Amazon Amazon Sale Sales Tax Amazon Purchases

Helpful Sales Tax Steps For Amazon Fba Sellers Sales Tax Amazon Fba Business Tax Return

States With Highest And Lowest Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

How To Register For A Sales Tax Permit Taxjar

Register For A Sales Tax Permit In The State Of Virginia Business Solutions Virginia Sales Tax

How Is Tax Liability Calculated Common Tax Questions Answered