st louis county sales tax car

The 2018 United States Supreme Court decision in South Dakota v. 2022 List of Missouri Local Sales Tax Rates.

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Contact the Delinquent Tax Department during regular business hours at 314-615-7865.

. 12000 x 004225 12000 x 00454 50700 53448 104148. Louis County Missouri sales tax is 761 consisting of 423 Missouri state. The Missouri state sales tax rate is currently.

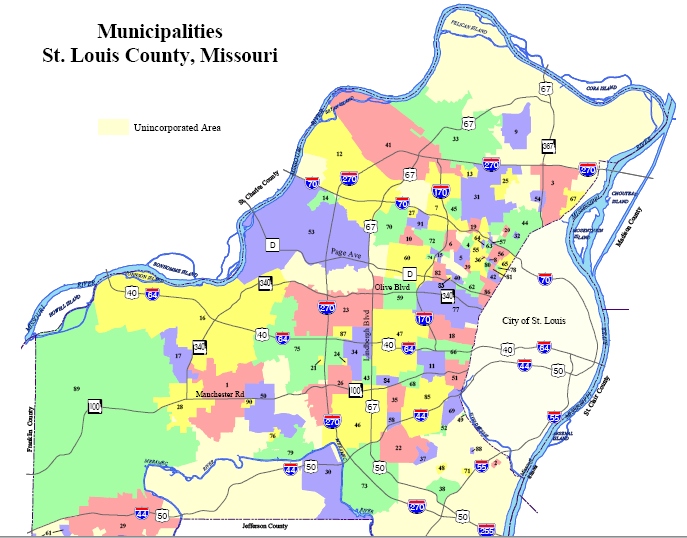

The local sales tax to be collected on the purchase price of motor vehicles trailers watercraft and motors at the time application is made for title if the address of the applicant is within a city or county listed below. Louis County where the combined cost is a whopping 11988. Interactive Tax Map Unlimited Use.

Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375. When a parcel becomes delinquent it is subject to a suit being filed. Louis Countys Real Estate Information to research any properties of interest.

Louis Sheriffs Office performs the sale and handles all of the post sale processes. To further accelerate investment and improve the quality of the countys vast. This is the total of state and county sales tax rates.

In conjunction with the 423 youll also need to pay a county or local sales taxwhich ranges widely. If this rate has been updated locally please contact us and we will update. The current total local sales tax rate in Saint Louis County MO is 7738.

A county-wide sales tax rate of 2263 is. Louis County will have a 05 percent transit sales and use tax and a 20 vehicle excise tax. Use the tax calculator to estimate the amount of tax you will pay when you title and register your new.

Has impacted many state nexus laws and sales tax collection requirements. Sales tax in Saint Louis County Missouri is currently 761. To review the rules in Missouri visit our state-by-state guide.

Home Motor Vehicle Sales Tax Calculator. Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in April 2015. The sales tax rate for Saint Louis County was updated for the 2020 tax year this is the current sales tax rate we are using in the Saint Louis County Missouri Sales Tax Comparison Calculator for 202223.

Home DEPARTMENTS A-Z Auditor About the Auditors Office. Revenues will fund the projects identified in the St. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date.

The tax sale occurs approximately one year after the suit is filed. A county-wide sales tax rate of 2263 is. Complete Policy Manual of the St.

The Missouri state sales tax rate is currently 423. Louis County Courthouse 100 North 5th Avenue West. 2020 rates included for use while preparing your income tax deduction.

Questions regarding the tax sale or the Post Third Sale Offerings. This rate is in addition to the state tax. Sales tax in Saint Louis County Missouri is currently 761.

44 rows The St Louis County Sales Tax is 2263. The Collector of Revenue processes the payments for all Real Estate parcels within the City of St. To arrive at this total multiply the sales price by the state tax rate of 4225 percent.

State Muni Services. The City of St. Their website states You must pay the state sales tax AND any local taxes of the city or county where you live not where you purchased the vehicleThe state sales tax rate is 4225 percent and is based on the net purchase price of your vehicle price after rebates and trade-ins.

Lowest sales tax 4725 Highest sales tax 11988 Missouri Sales Tax. April 2015 Page 1 of 2 Starting April 1 2015 St. 6 rows The St.

Average Sales Tax With Local. Ad Lookup Sales Tax Rates For Free. Then multiply the sales price by the local sales tax rate of 4454 percent and add the two figures for example.

The December 2020 total local sales tax rate was 7613. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. We cannot accept incomplete bids and do not provide notary services.

Motor vehicle titling and registration. 44 rows The St Louis County Sales Tax is 2263. Youll pay that flat rate when buying a new car used car or that old beater from your uncles garage.

Louis County Greater MN Transportation Sales and Use Tax Transportation Improvement Plan adopted December 2. Local sales tax is highest in St. For additional information click on the links below.

The minimum combined 2022 sales tax rate for St Louis County Missouri is. There are a total of 731 local tax jurisdictions across. The St Louis County sales tax rate is.

The Minnesota Department of Revenue will administer these taxes.

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Missouri Car Sales Tax Calculator

Ford Dealership Near St Louis Mo Bommarito Ford

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Used Car Dealer In St Louis Mo 63136 Drivetime

Cars For Sale In Saint Louis Mo St Louis Auto Car Sales

181 Used Cars For Sale St Louis Chesterfield Frank Leta Acura

Car Sales Tax In Missouri Getjerry Com

Used Pickup Truck For Sale Finance Deals Earth City Mo

Temp Tags New Missouri Vehicle Sales Tax Law Takes Effect In August Fox 4 Kansas City Wdaf Tv News Weather Sports

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Used Car Dealer In St Louis Mo 63125 Drivetime

St Louis County Tax Fight Heats Up As Region Seeks Economic Unity Nextstl

Online Payments And Forms St Louis County Website

Enterprise Car Sales Home Facebook