does indiana have estate or inheritance tax

Web Instead some Indiana residents may have to pay federal estate taxes. Even though there is a state tax.

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

You do not need to pay inheritance tax if you received items from an Indiana resident who died after.

. Web Indiana does not have an inheritance tax nor does it have a gift tax. Web Indiana repealed the inheritance tax in 2013. Web Receive 11 in-depth advice on the next steps should be to reduce your inheritance tax.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. If you are curious about the six states that impose state-level estate taxes. For individuals dying before January 1 2013.

There is no inheritance tax in Indiana either. Discussion on what options are open to you based on your estate and what your. However other states inheritance laws.

Indiana has no state taxes on inheritance or estates of residents. Web Up to 25 cash back Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other. Web Indianas inheritance tax still applies.

In general estates or beneficiaries of. Web The transfer of a deceased individuals ownership interests in property including real estate and personal property may result in the imposition of inheritance tax. These taxes may include.

Web The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate. Web In fact the Indiana inheritance tax was retroactively repealed as of January 1st of 2013. Web Unlike neighboring Wisconsin Michigan Indiana and Missouri Illinois is one of just a dozen states that still have an estate or inheritance tax.

In fact the Indiana inheritance tax was retroactively repealed as of January 1st of 2013. Web In 2021 rates started at 108 percent while the lowest rate in 2022 is 116 percent. Web Although the State of Indiana did once impose an inheritance tax the tax was repealed for deaths that occurred after 2012.

Web Indiana is one of 38 states in the nation that does not have an estate tax. Are required to file an inheritance.

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis Estate Planning Attorneys

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Indiana Inheritance Laws Tips To Keep Wealth In The Family

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

Indiana Department Of Revenue Inheritance Tax Section Indianapolis Bar Association Estate Planning And Administration Section March 28 2012 Don Hopper Ppt Download

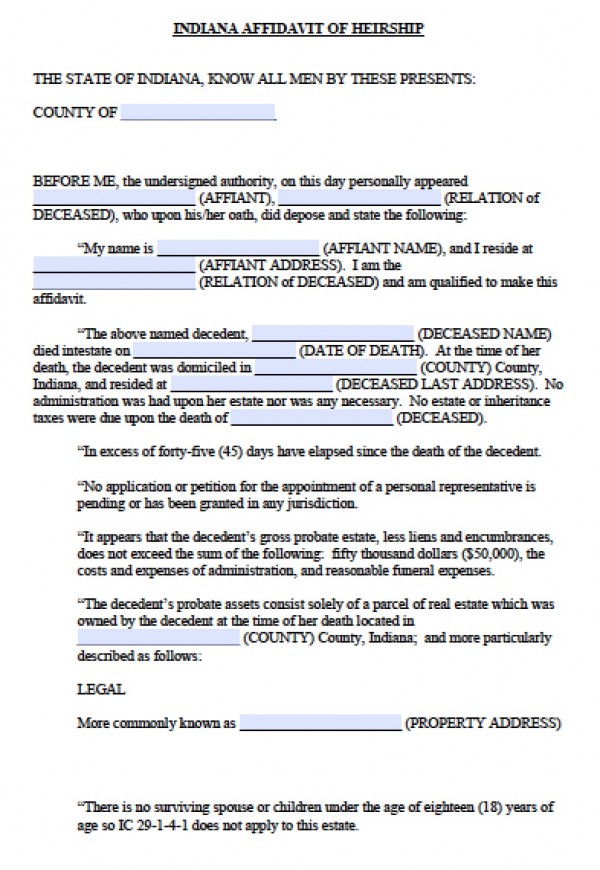

Free Indiana Affidavit Of Heirship Form Pdf Word

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How Much Is Inheritance Tax Community Tax

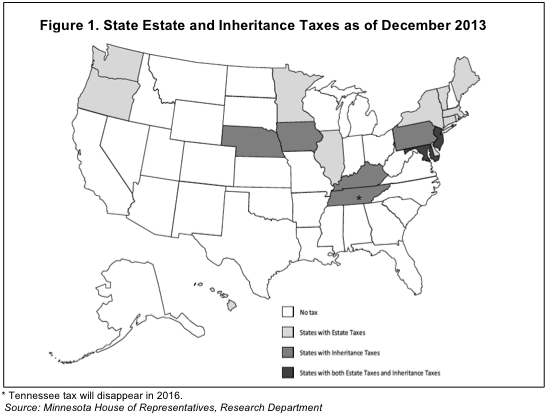

State Estate And Inheritance Taxes

:max_bytes(150000):strip_icc()/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

:max_bytes(150000):strip_icc()/GettyImages-182219577-6ab97665cebd48b0912463655cc12347.jpg)

How Inheritance And Estate Tax Waivers Work

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Welcome To The State Death Tax Manager Leimberg Leclair Lackner Inc

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Indiana Estate Tax Everything You Need To Know Smartasset

2021 Estate Income Tax Calculator Rates

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

What Do I Need To Know About New York State Gift And Estate Taxes Russo Law Group