unemployment insurance tax refund

The IRS has sent 87 million unemployment compensation refunds so far. Get in Touch.

Unemployment Benefits Tax Issues Uchelp Org

Irs Tax Refund in Piscataway NJ.

. This taxable wage base is 62500 in 2022. File a Quarterly Wage Report. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

The state financial help does not need to be reported with the federal Advance Premium Tax Credit. The IRS has been issuing refunds since May and has returned over 10 billion to over 87 million people so far the agency says. Every employer in Tennessee is required to fill out a Report to Determine Status Application for Employer Number LB-0441.

Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account. This is the fourth round of UI tax refunds the. View Benefit Charge and Rate Notices.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. State of Ny Asmblymn Unemployment Insurance Tax Services. The Capital IRS Tax Group.

Notice for Pandemic Unemployment Insurance Claimants. Fort Lee NJ 07024 201 308-9520. UI Tax Payment by ACH Debit.

Name A - Z Sponsored Links. File Wage Reports Pay Your Unemployment Taxes Online. Submitting this form will.

Use the Unemployment Tax and Wage System TWS to. For additional information pertaining to the electronic filing regulation and requirements contact the Employer account Service unit at 866 4299757. State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base authorized in RCW 5024010.

IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes. Government Offices State Government. For any Unemployment Insurance Tax questions please contact the UI Operations Center at 1-877-664-6984 Monday through Friday 800 am.

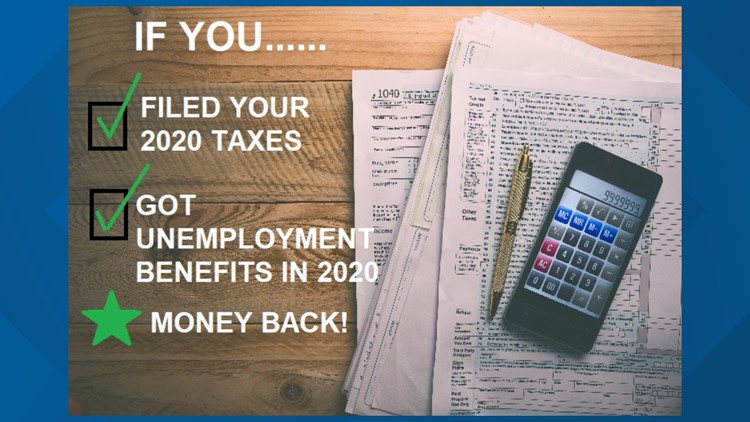

Do not include the New Jersey Health Plan Savings NJHPS on your federal tax return. File a Report of Change. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

60 N Taylor Ave. Nebraska businesses of every size and industry use NEworks to connect with thousands of highly qualified job seekers including a large bank of professionals high-skill individuals and. Effective July 27th 2021 you will no longer be able to file a new PUA claim through this portal.

Unemployment Tax Refund Taxpayers Frustrated By Irs Unresponsiveness

How To Get A Refund For Taxes On Unemployment Benefits Solid State

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

The Irs Will Refund Those Who Overpaid Taxes On Unemployment Benefits

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

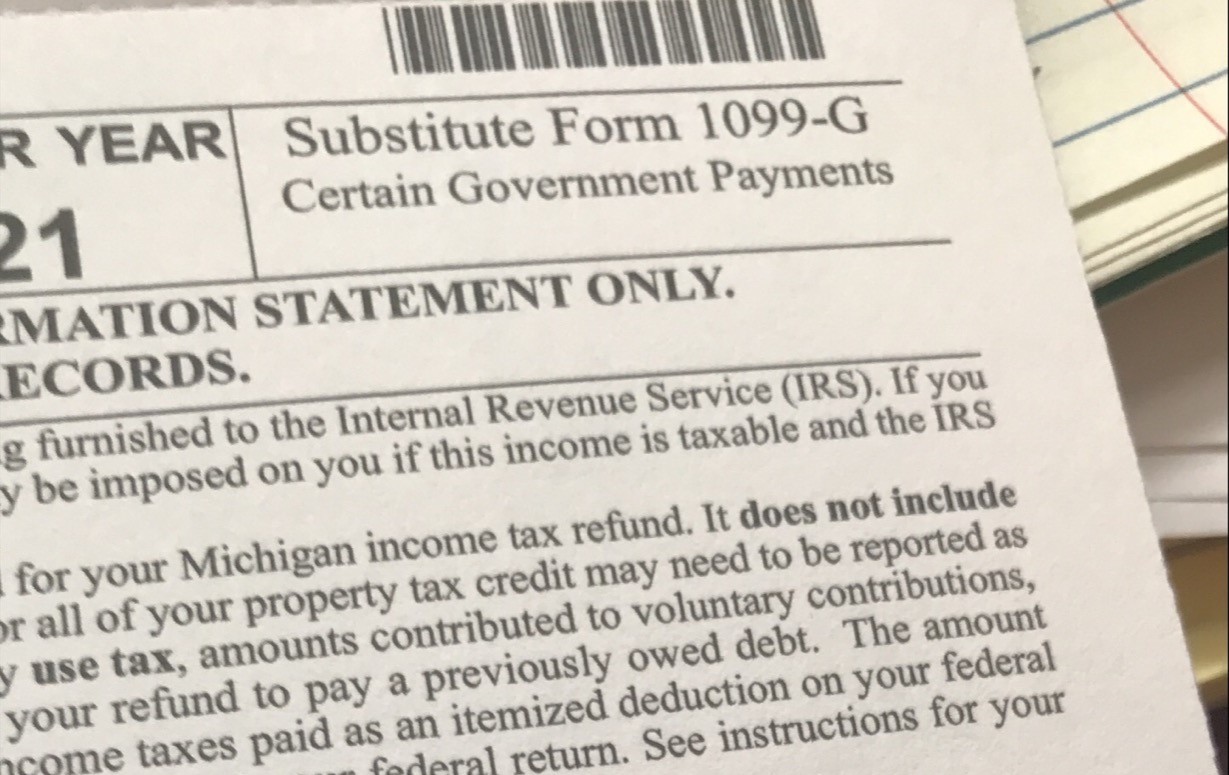

What Is A 1099 G Form And What Do I Do With It

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Unemployement Benefits Are This Payments Taxable Marca

Year End Tax Information Applicants Unemployment Insurance Minnesota

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

Filing Your Taxes If You Claimed Unemployment Benefits What To Know Where To Find Help Kqed

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

2021 Unemployment Benefits Taxable On Federal Returns King5 Com

What You Need To Know About Unemployment Tax Refund Irs Payment Schedule And More Brinker Simpson

Tax Refund Whiplash Pandemic Perks Give Some A Windfall Others A Bill Politico

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Recipients Of 2020 Unemployment Benefits May Be Eligible For Arizona Income Tax Refund San Tan Valley News Info Santanvalley Com